We have discussed trendline and its significance to trading and to understand channel which is a continuation of the trendline, then we suggest you read trendline. The channel line is when prices trend between two parallel lines. A well-drawn channel can be a real clue to positioning yourself to harness profits.

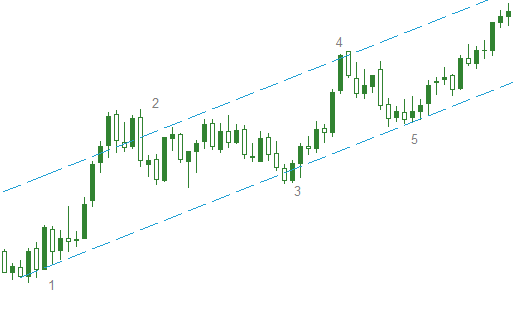

Ascending Channel

The drawing of a channel line does look simple. In an uptrend, you need first to draw the basic up trendline along with the lows. Then you draw a parallel line from the first prominent peak which is parallel to the basic up trendline. The lines move up to the right and they form an ascending channel. If the next rally reaches and back off from the channel line (point 4 of the image above) then a channel may exist. If prices drop back to the basic up trendline (point 5 of the image above) then a channel probably does exist. The up channel could assist a trader to initiate a new long position.

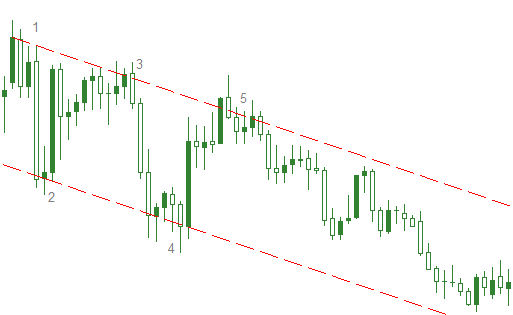

Descending Channel

To create a descending channel, you need to establish the downtrend first and draw a parallel line with the same angle as the downtrend. Then you need to move the point to the most recent peak to establish a valid down channel line. By all indications, range traders can use the descending channel to detect a profitable short position.

Channel Breakout

Up channel is characterised by higher highs and higher lows with a line pointing upward. Down channel consists of a lower highers and lower lows with a line pointing downward. When the currency prices approach the upward or the downward line and crosses them then a channel breakout is said to have taken place. When you have a break of the major trendline, this indicates an important change of trend. If the channel line is impeccable drawn following some guiding principles or strategies and a breakout occurs then it is a good opportunity to invest in the market